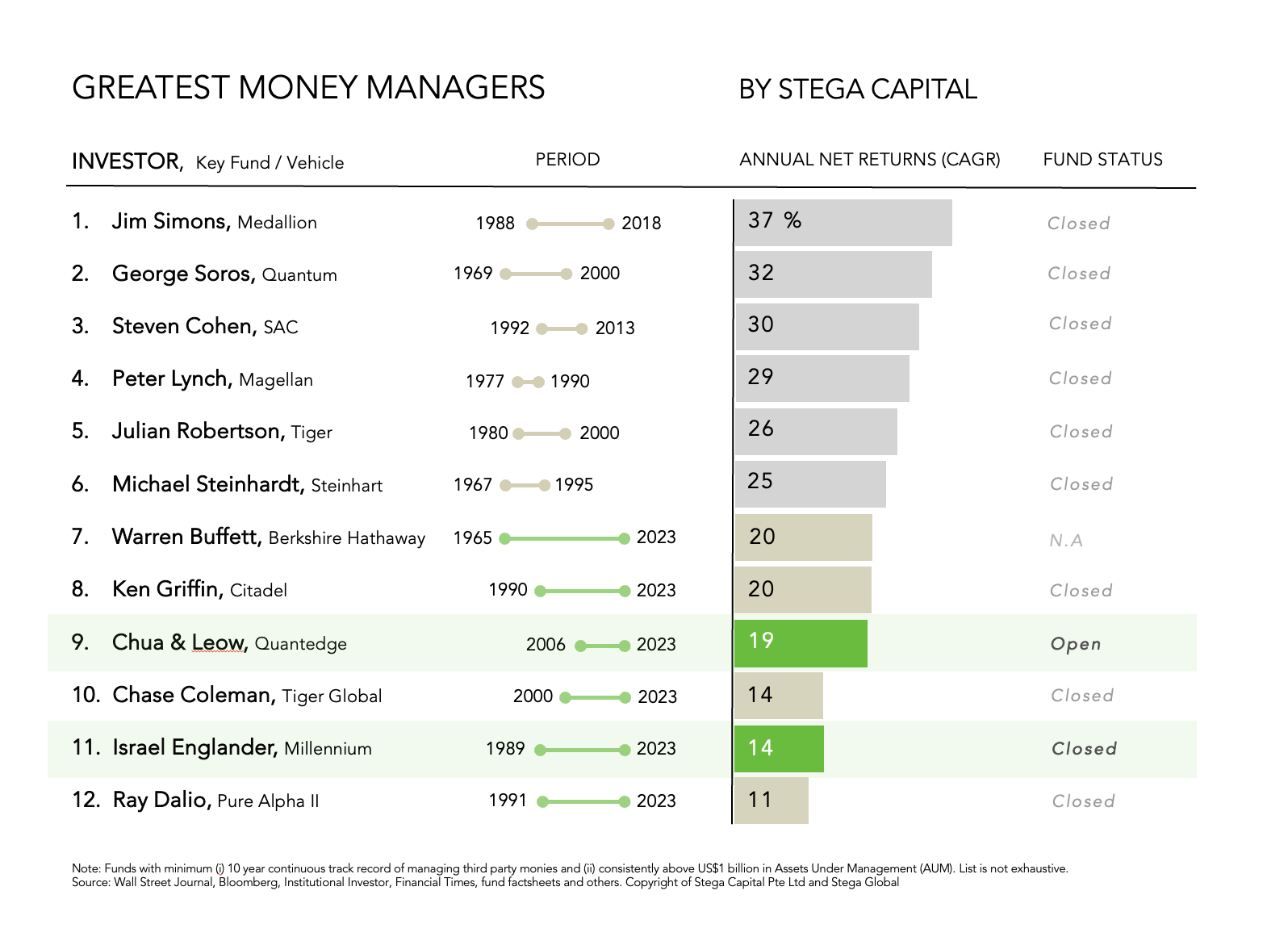

Since 2006, our Principals have invested in hedge funds by taking a multi-decade view and embracing elevated volatility (σ). Backed by permanent capital, we believe above-average returns require patience, and a willingness to tolerate risk that most avoid.

How can we help?

1. For Accredited Investors, we provide aligned access through our co-investment fund, Stega Global.

2. For Family Offices / Institutions, we offer capital introductions to our longest standing GP / hedge fund relationships.

“EXPECT OVER 50% loss IN A SEVERE CRISIS”

OUR PORTFOLIO

We monitor the following for our Investment Office portfolio.

HOW WE CAN HELP

1. For Accredited Investors, we provide aligned access through our co-investment fund, Stega Global.

2. For Family Offices / Institutions, we offer capital introductions to our longest standing GP / hedge fund relationships.

QUICK READS

ABOUT US

Our principals, Satoko and Michael, have been investing in hedge fund strategies since the 2000s. Before co-founding Stega as an Investment Office, they held diverse positions at Goldman Sachs, Merrill Lynch, and Japan Gamma Asset Management. Their expertise spans M&A, macro research, trading and portfolio management. Beyond finance, they are avid divers, skiers, as well as advocates for scholarship preparatory programs.