UPDATE

We initiated the divestment of Prulev Global Macro Fund Class C shares in March 2022 and completed the process by May 2022 for our ‘Q2’ Fund of Fund. While we do not provide specific reasons for the sell-down, our general thoughts on the matter can be found in our Divestment Guide as well as the review below.

Regards,

Stega Investment Team

“ - 78% Maximum Drawdown”

Prulev REVIEW

First published in October 2021. Last updated in July 2022.

BACKGROUND

We have the utmost respect for Norman and August, the founding Portfolio Managers of Prulev Global Macro Fund. From Prulev’s inception in 2012 till 2020, they achieved a staggering +50% annualised return and +3,500% total return. To put things into perspective, these annualised return figures topped even hedge fund luminaries like Jim Simmons (Medallion), George Soros (Quantum) and Julian Robertson (Tiger).

Our thesis of investing in Prulev was driven by (i) a very high correlation to our benchmark fund, Quantedge, and (ii) Prulev having a unique discretionary, event-driven tilt overlay on top of a Quantedge-like ‘risk-premia’ base strategy. The subtle difference, resulted in a blistering outperformance where Prulev trumped Quantedge returns, year after year, without fail, prior to the commencement of its ongoing record losses which started in September 2021. Statistically speaking:

Prulev recorded 7 instances of >20% single month gain in its shorter ~10 year history relative to Quantedge whom only had 1 such big-win month since 2006.

Both Prulev and Quantedge are fairly well matched in terms -20% or greater monthly loss (three times) and -10% or greater monthly loss (fourteen times) in its history prior to September 2021.

Over time, Prulev’s higher absolute upside, and similar downside profile led to an outperformance of 2 to 3x over Quantedge prior to September 2021.

Prulev Highest Single Month Returns (%)

Discretionary views

At its core, Prulev identifies itself as a systematic, event-driven, global macro strategy. A cursory review of their big-wins can be explained by their hybrid systematic & discretionary views on global events.

Prulev’s largest +47% monthly gain in January 2015 benefitted from the view that the Swiss Franc could be unpegged from the Euro, which subsequently led to a drastic increase in the Swiss stock market.

Prulev’s +21% monthly gain in June 2016 benefitted from the view that Brexit was more likely to occur than what the markets predicted.

It is quite likely due to these correct, discretionary guesses that Prulev succeeded in clinching their multiple big-wins. But what about the opposite?

Phase 1: September & October 2021

Prulev’s monumental -45% drawdown over Sep. and Oct 2021 was strange. There was no major meltdown reported anywhere in the wider financial media; no Lehman moment, no Fed Taper Tantrum, no nothing. In fact, global equity markets were fairly hunky-dory and similar strategy funds reported nothing of this magnitude.

From a risk management perspective, Prulev employs risk limits whereby a single country cannot exceed 20% of its overall risk budget. In the fixed income world, the most liquid markets are found mainly in OECD countries. Hence, Prulev have always focused its non-U.S fixed income diversification efforts into a handful of OECD countries such as Australia, New Zealand, Canada and the U.K amongst others.

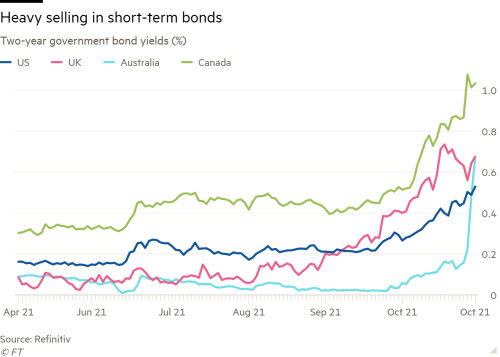

In October 2021, a rare-but-massive, concentrated earthquake occurred in the short-term bond segment of the fixed-income markets Prulev were in. Short-term bonds, which are bonds with less than 5 years in maturity, generally have the lowest volatility among all other maturities (10, 30 years). Using the standard risk-based-allocation methods, you are likely to observe the highest level of leverage being employed in the short-term bond segment, which may result in monumental losses if the market moves against you. While Quantedge and other risk parity-driven funds could be doing the same, none of them has thus far exhibited this level of positioning in the short-term bond segment of the very same countries that Prulev is in. Hence, the damage is not widespread across its peers and unique to Prulev.

Prulev’s fixed income losses in Australia, Canada and New Zealand accounts for roughly 2/3 of their total losses in their fixed income portfolio (-37%). The underlying market movements in the short-term bond space in these countries concur with their newsletter explanations.

In Australia / NZ, declines in short-term bonds was the most severe since 1996.

In Canada, declines in short-term bonds was the most severe since 2009.

To summarise, they were hit by wrong positioning and unfavourable market movements in a niche, short-term bonds space which kicked off the first phase of their -45% decline.

When bond yields go up, bond prices go down.

Phase 2: JANuary to JUNE 2022

From January to June 2022, Prulev suffered consecutive, monthly losses which cumulated in a ~80% maximum drawdown situation. From an attribution standpoint, we noted that the losses from its fixed income portfolio accounts for 50% - 95% of its monthly total loss during the period which could indicate the Managers’ steadfast view on the positioning of its fixed income portfolio relative to the market; and their willingness to tolerate incredible amounts of pain to adhere to it. Anecdotally, Norman and his family office announced that they added US$5 million of fresh capital in February and March 2022 which has since lost about half its value.

Prulev 1H2022 monthly returns (%)

FINAL THOUGHTS

Thus far, we postulate that Prulev’s record drawdown was due to a combination of:

The Manager’s persistent fixed income views with differs from the wider market;

Their above-average loss tolerance appetite to adhere to such views;

The eventual market outcome which went against their strongly held views.

Our early hypothesis was subsequently validated by a letter penned by the CIO of Prulev (enclosed in quote). We hope that Norman, August, Rieman and Dinesh will be patient in guiding Prulev to its recovery.

Best regards,

Stega Investment Team

A single wrong bet may not kill you, but a wrongly sized one could.

“The performance over the past 11 months has been disappointing and upon reflection, we underestimated the persistence of inflation and were definitely taken by surprise by the course of Ukraine war and its continuing impact on inflation.”

FURTHER READS

PHASE 1 MEDIA ARTICLES

PHASE 2 MEDIA ARTICLES